CommunityProfit.org

Educate,

Monitor

& Defend

Defending ERC Program Eligibility Rights for Businesses Impacted by the Pandemic.

Our Mission

To protect and defend the rights of those businesses impacted by the pandemic claiming employee retention credits.

Community Profit exists to provide an unbiased and fair perspective to the business community on the Employee Retention Credit (ERC) program. Since its inception, the ERC has been difficult to understand, and the Internal Revenue Service has struggled to provide consistent, reliable guidance. The ERC was created by Congress to aid businesses in surviving and recovering from the financial stress created by pandemic-era government restrictions. A combination of IRS FAQs, Notices, and press releases still leaves many taxpayers confused as to the extent and limits of ERC applicability. Many business owners feel claiming the ERC puts a target on their back for the IRS. Even more frustrating to taxpayers has been the application of ERC rules within an IRS audit. Unfortunately, IRS auditors appear to be the least familiar with the IRS Notice language and consistently misapply concepts such as “more than nominal” and “partial suspension”, leaving taxpayers frustrated or worse.

Community Profit exists to provide clarity and advocacy to the business community by sharing information such as ERC audit requests for information, ERC audit decisions, access to government orders no longer readily available, and ERC guidance in any reliable form.

Our mission is to create a safe haven for taxpayers to find reliable ERC information in a sea of misinformation. The ERC was and is intended to provide much needed support to business owners and should not be viewed as a scam. Many business owners have correctly claimed this refundable payroll tax credit and those who haven’t should consider their eligibility through a well informed lens rather than a lens of fear.

To learn more about the ERC program:

-

https://www.chamberlainlaw.com/news-publications-plain_meaning_analysis_erc_tax_november_2023.html

-

-

https://www.experian.com/blogs/employer-services/who-qualifies-for-the-erc-tax-credit/

-

Frequently asked questions about the Employee Retention Credit | Internal Revenue Service (irs.gov)

Educate & Lobby

Community Profit advocates for closing the gap between the laws governing the ERC Program and the IRS guidance, which is arguably more restrictive that the statutory language. We engage with CPAs, attorneys, policymakers, businesses, and stakeholders.

Monitor & Police

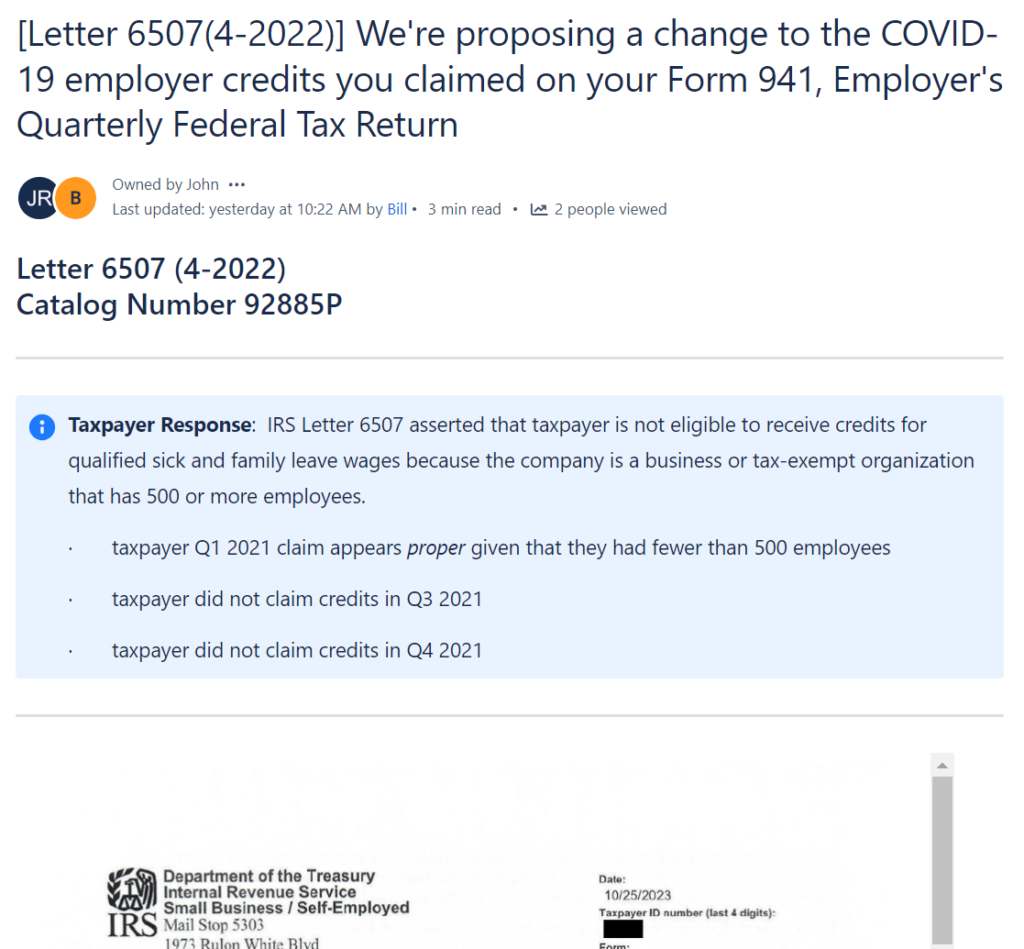

Community Profit has developed a remote-friendly team workspace for tax professionals where ERC knowledge and collaboration meet. We call this AI powered workspace Lighthouse.

Support & Defend

Lighthouse is used to aggregate, organize and analyze legislation, insights from industry experts, IRS guidance, state and local governmental orders, IRS Information Data Requests and taxpayer response strategies.

Take Action

The original law governing the employee retention credit was enacted quickly and without precedent. The IRS has worked hard to provide guidance, but some of that guidance is arguably more restrictive than the statutory language. Businesses operating in this vacuum need a national voice on the plain meaning of the ERC legislation and a community to protect the rights of businesses to legitimately claim and defend their payroll refunds. Help us to protect access to the ERC program.

Get the Latest ERC News

- Insights from leading accounting and legal experts

- Searchable, indexed database of all COVID related federal, state, and local orders

- Real-time tracking of Treasury and IRS ERC announcements

- Congressional and Congressional committee ERC pronouncements, hearings, and letters

IT’S A TURBULENT TIME FOR ERC. HELP MAKE A DIFFERENCE.

Connect With Us

Pressure is mounting on all ERC community constituents. Congressional leaders need to formalize how and to what extent they will support constituents that have or will file for ERC claims. IRS needs to respond to claims, fortify its processes, respond to Congress, and audit claims already paid. ERC thought leaders need to deliver their critical insights to the broader community in a way and manner that generates maximum impact. Business leaders need to understand their audit risk timeline, their decision to file or not, and where to go for credible ERC content. ERC providers need to understand how they support their clients in a claim submitted and post payment environment.